Prysmian: solid profitability and upgrade to FY2024 guidance

- ADJ. EBITDA STOOD AT €869 MILLION, WITH THE MARGIN AT 11.1%

- SOUND IMPROVEMENT IN TRANSMISSION; ADJ. EBITDA MARGIN ROSE TO 13.8% (11.6%, 1H23), WITH EXCELLENT ORGANIC GROWTH (+9.5%)

- STRONG MARGIN CONFIRMED IN POWER GRID AT 13.2% (10.2%, 1H23), THANKS TO GRID ENHANCEMENT IN NORTH AMERICA & EMEA

- GROUP NET PROFIT AT €402 MILLION

- EXCELLENT CASH GENERATION WITH FREE CASH FLOW LTM AT €889 MILLION

- PRYSMIAN REINFORCES ITS DECARBONISATION PATH WHILE INCLUDING ENCORE WIRE IN THE PERIMETER

- FY24 OUTLOOK UPGRADED, DRIVEN BY THE STRENGTH OF PRYSMIAN’S PERFORMANCE, AS WELL AS FROM THE CONTRIBUTION OF ENCORE WIRE IN 2H1 :

- Adjusted EBITDA expected in the range of €1,900–€1,950 million

- Free Cash Flow expected in the range of €840–€920 million

- Scope 1&2 GHG emission reduction of 36% and Scope 3 reduction of 13% vs. 2019

Massimo Battaini, Prysmian CEO, said: “The first half of 2024 results underline that Prysmian’s profitability remains solid and that it is well-positioned to benefit from the long-term trends in energy transition and digitalisation to achieve future organic growth. The upgraded guidance for the 2024 full year follows not only to our acquisition of Encore Wire, which was completed ahead of expectation, but also thanks to our disciplined focus on profitability and sound cash generation. These achievements have also been made while Prysmian continues to take strides in reducing carbon emissions and growing its revenues from sustainable products, which have a clear and measurable impact on the planet and society.”

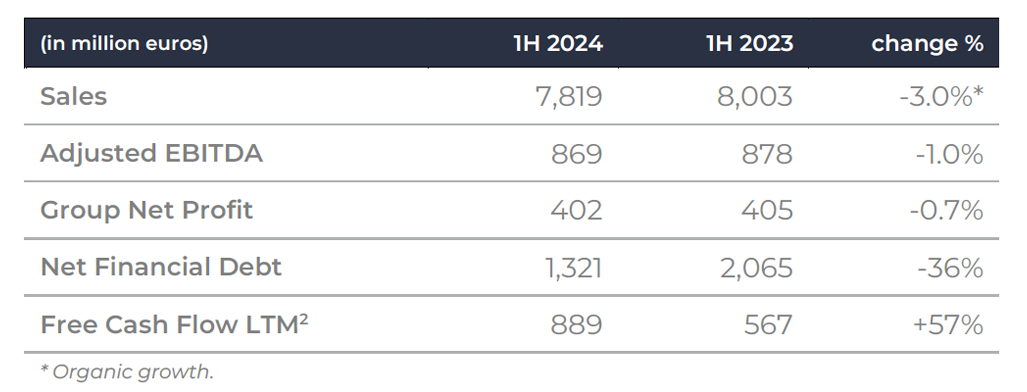

FINANCIAL HIGHLIGHTS

The Board of Directors of Prysmian S.p.A. have approved the Group’s consolidated results for the first half of 2024.

Group Sales amounted to €7,819 million, with a -3.0% organic growth. The strong organic growth generated by the Transmission business (+9.5%), and Power Grid (+1.7%) was offset by a contraction in sales in both the Electrification and Digital Solutions businesses.

Adjusted EBITDA reached €869 million (€878 million, 1H23), with a stable margin at 11.1% (11.0%, 1H23). The adjusted EBITDA, and adjusted EBITDA margin, of Transmission rose to €150 million, and 13.8%, respectively, while Power Grid’s adjusted EBITDA grew by 31.5% to reach €238 million, with the margin at 13.2%. In the Electrification business, the adjusted EBITDA margin of the Specialties segment improved to reach 11.5%, with the adjusted EBITDA standing at €179 million, while in the Industrial & Construction segment the margin declined to 9.0%, with the adjusted EBITDA at €224 million. The Digital Solutions business saw a second consecutive quarter of improvement to reach €76 million, while the adjusted EBITDA margin was 11.6%.

EBITDA was €801 million (€828 million, 1H23), including net expenses for company reorganisations, non-recurring expenses, and other non-operating expenses of €68 million (€50 million, 1H23).

Net profit stood at €410 million (€413 million, 1H23). Net profit attributable to owners of the parent company amounted to €402 million (€405 million, 1H23).

Free Cash Flow LTM rose to €889 million, up by 57% compared to €567 million at June 2023. In 1H24, the free cash flow was negative for €165 million, affected by the usual seasonality of the business, and significantly improved when compared with the €329 million negative free cash flow at 1H23.

Net Financial Debt fell sharply to €1,321 million at 30 June 2024 (€2,065 million, 1H23), driven by strong cash flow generation and by the partial conversion of the “soft called” Convertible Bond, net of the outflows related to the ongoing share buy-back (a net positive effect of €253 million). The conversion of the Convertible Bond was completed within the month of July.

1 Encore Wire will be included within the Group perimeter as of 1st July 2024.

2 FCF excluding Acquisitions & Disposals and Antitrust impact. LTM (last twelve months).