2028 TARGETS: PRYSMIAN TO ACCELERATE GROWTH

- 2028 TARGETS

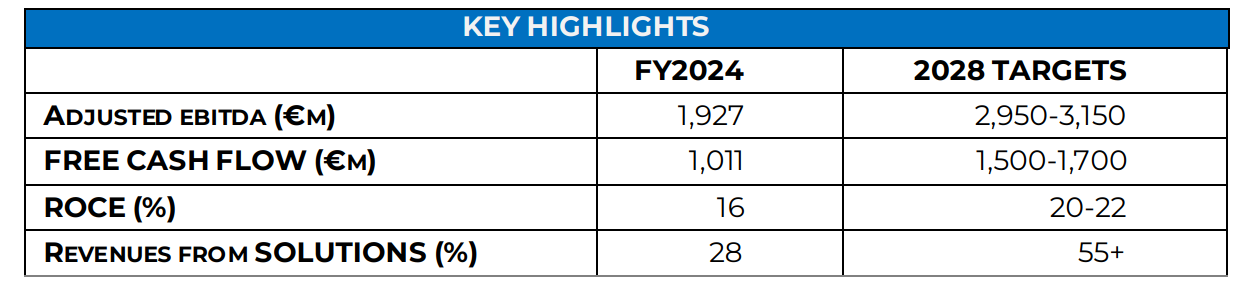

- Profitability enhancement: €2.95 billion to €3.15 billion adjusted EBITDA range

- Strong cash flow generation: €1.5 billion to €1.7 billion free cash flow range

- Superior shareholder returns: 15% to 19% 2024-2028E EPS CAGR range1

- Solutions provider: more than 55% of revenues as solutions

- REINFORCING CAPITAL EFFICIENCY

- Cumulative free cash flow 2025-2028 of approximately €5 billion, with:

- €1.1 billion for dividend, +12% 2024-2028 DPS CAGR

- €1.3 billion for deleveraging

- €2.6 billion2 mostly for M&A or enhanced shareholder cash returns

- Cumulative free cash flow 2025-2028 of approximately €5 billion, with:

STRATEGY UNDERPINNED BY:

- UNMATCHED SYNERGISTIC PORTFOLIO: Unique offer positions Prysmian as the one-stop-shop for solutions to capture growth faster than the competition.

- TALENTED AND COMMITTED PEOPLE: M&A fuelled diversity unlocks a rich know-how and performance driven mind-set.

- GROWTH-ORIENTED INNOVATIVE AND SUSTAINABLE SOLUTIONS: Acceleration in Prysmian’s journey from cable maker to world class solutions provider.

INNOVATION AND SUSTAINABILITY DRIVING GROWTH:

- NEW PRODUCT VITALITY TO RISE TO 30% by 2028: Innovation will enhance, scale up and unlock solutions in close partnership with customers.

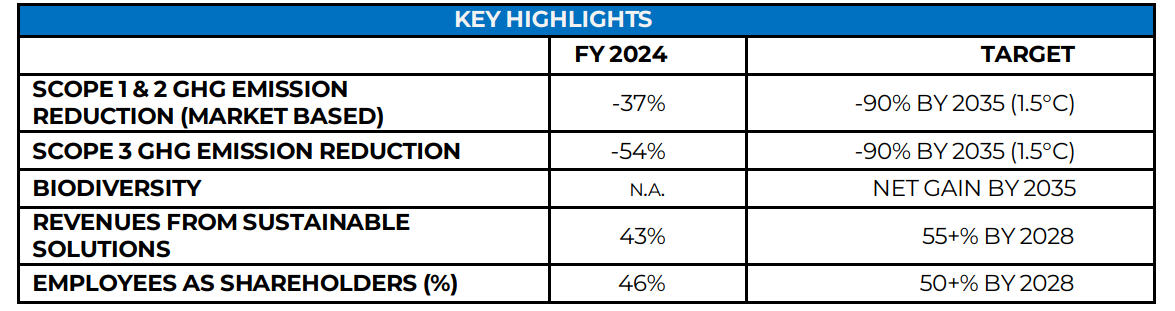

- ACCELERATING TO ACHIEVE NET ZERO BY 2035: Scope 1, 2 and 3 carbon emission reductions, will bring Prysmian to Net Zero by 2035, in advance of its prior 2050 target.

- BIODIVERSITY, NET GAIN BY 2035: enhancing the positive impact on ecosystems.

- MORE THAN 55% OF REVENUES FROM SUSTAINABLE SOLUTIONS BY 2028: thanks to the strong focus on decarbonization and circular economy.

- MORE THAN HALF OF ALL EMPLOYEES TO BE SHAREHOLDERS: Value creation to be underpinned by a culture of shared ownership.

PRYSMIAN’S ACQUISITION OF CHANNELL TO STRENGTHEN ITS DIGITAL SOLUTIONS BUSINESS, NORTH AMERICAN FOOTPRINT AND SYNERGISTIC PORTFOLIO3

Massimo Battaini, Prysmian CEO, said: “Since Prysmian’s first Capital Markets Day in October 2023 we have been working hard to create value for all stakeholders, and thanks to these efforts, we have been able to achieve, in advance, the targets that we shared with the market. Today we set out the next phase of our journey with mid-term targets that will drive us to accelerate faster. The trends behind our business are clear and numerous, from the increased demand for energy and electrification to global digitalization, there has never been a better moment to achieve organic growth, and Prysmian is the best-positioned player to take full advantage of these opportunities. Our journey from cable manufacturer to world class solutions provider has been significant and this will now also accelerate thanks to the acquisition of Channell; and thanks to our global leadership position and track record of delivery, we will continue to generate long-term sustainable value creation for people, the planet, our employees, and shareholders.”

New York City, 25th March 2025 - The Board of Directors of Prysmian S.p.A. have approved the mid-term targets and 2025-2028 strategic plan, which will be presented today at Prysmian’s Capital Markets Day.

The strategy will build on the outline set at Prysmian’s first ever Capital Markets Day, held in Naples, Italy in 2023, with accelerated targets to achieve growth and create value for all stakeholders.

Prysmian will focus on increasing profitability, shareholder value creation and its long-term transformation from cable manufacturer to solutions provider across this 4-year period.

This acceleration will be underpinned by both organic and inorganic growth, driven by Prysmian’s highly complementary and synergistic portfolio, together with Prysmian’s leadership position in both innovation and sustainability. Alongside its partners, Prysmian will create new opportunities arising from solid market trends in energy transition and security, electrification, decarbonization and digitalization.

MID-TERM FINANCIAL TARGETS AND CAPITAL ALLOCATION

FINANCIAL TARGETS

Prysmian will target a significant increase of adjusted EBITDA, to rise to a range of €2,950 million to €3,150 million, up from €1,927 million in 2024. The total CAGR 2024-2028 would be 12.2%. The free cash flow range for 2028 also increases to €1,500 million to €1,700 million, up from €1,011 million at FY24, with a % EBITDA conversion in free cash flow of greater than 50%. This guidance includes the contribution of the acquisition of Channell for a total of €150 million in the adjusted EBITDA in 2028.

Prysmian is also targeting an estimated 2024-2028 EPS CAGR range of 15%-19%, with an adjusted EPS4 of 4.60-5.20 euro per share in 2028, up from 2.81 euro per share in 2024.

In addition, the ROCE target is between 20% to 22%, up from 16% in 2024.

The cumulated level of capex over the 2025-2028 period will total €2.6 billion (€650 million per year on average), led by the investment in the Transmission business.

Prysmian will also continue its transformation from cable manufacturer to solutions provider, with the percentage of revenues coming from solutions to rise to more than 55%, up from 18% in 2010 and 28% in 2024.

KEY ASSUMPTIONS

These goals assume no material changes in the geopolitical situation, in addition to excluding extreme dynamics in the prices of production factors or significant supply chain disruptions (including impacts from tariffs). The forecasts are based on the Company's current business perimeter - including the closing of the acquisition of Channell - assume a EUR/USD exchange rate of 1.07, and do not include impacts on cash flows related to antitrust issues.

CAPITAL ALLOCATION

Over the period 2025-2028, Prysmian is expected to generate circa €5 billion in cumulative free cash flow, and identifies three main priorities to deploy its capital allocation strategy:

- Dividend increase

Prysmian foresees a progressive increase in the dividend per share distributed to shareholders by approximately 12% year-on-year, starting from the dividend paid in 2024. Approximately €1.1 billion of the cash generated during the 2025-2028 period will be allocated to dividends.

- Deleverage

Debt reduction is confirmed as a strategic pillar of the capital allocation strategy. Prysmian expects to continue to deleverage, aimed at reaching a run-rate of 1.0x - 1.5x net debt/Adj. EBITDA ratio and therefore further strengthening its financial structure. Approximately €1.3 billion of the expected cash flow generated during the 2025-2028 period will be used for further debt reduction.

- M&A and/or Enhanced shareholder return

Approximately €2.6 billion of the cash generated is expected to be deployed mostly in M&A and/or enhanced shareholder cash returns, mainly starting from 2027. The split between the two options will depend on the M&A opportunities that will arise in the period considered.

ACCELERATING LEADERSHIP

Prysmian will build on its previous “Connect to Lead” strategic plan by accelerating growth across its four areas of business – Transmission, Power Grid, Electrification and Digital Solutions.

The strategy will be underpinned by Prysmian’s unmatched synergistic portfolio, which offers customers a true one-stop-shop, enabling Prysmian to take full advantage of growth opportunities ahead of competitors. It will also rely on Prysmian’s talented and committed people, which have benefited from the cultural advantages that have emerged from prior M&A activities including a broad diversity of know-how and a performance driven mind-set. Finally, it will also be underpinned by growth-oriented innovative and sustainable solutions, accelerating Prysmian’s direction to world class solutions provider.

Prysmian’s four lines of business, Transmission, Power Grid, Electrification and Digital Solutions will all be boosted by long-term secular growth trends.

TRANSMISSION

In Transmission, Prysmian foresees that the global market value5 will be between €15 billion and €20 billion each year between 2025-2030, led primarily by Europe thanks to the development of offshore wind, interconnectors and high voltage land transmission. Prysmian is seeking a 25% to 28% CAGR in Transmission adjusted EBITDA thanks to capacity expansion and projects with better margins over the period 2024-2028. This will also be driven by Prysmian’s technological leadership in this business, its fully vertical integration and unique inspection, repair and maintenance service.

Prysmian’s transmission backlog as of March 2025 stands at €16 billion, with an additional €3 billion of orders awarded yet to be assigned to the backlog, pending notice to proceed. 90% of the backlog is with transmission system operators (TSOs), and 86% is in EMEA.

POWER GRID

In Power Grid, Prysmian will seek organic growth across its high and medium voltage cable solutions, also including solutions such as asset monitoring services to support the development of a smart and more resilient grid. Prysmian’s position in the market will be boosted by its global leadership enabled by local presence, its focus on sustainability and innovation, and its ability to help bring down scope 3 and 4 carbon emissions with customers. The Board of Directors have also approved an investment of approximately $245 million in North America to enhance the production of medium voltage cables. The project will be completed by the third quarter of 2027. The investment to strengthen Prysmian’s leadership position in the North American power grid, which will be subject to upgrades and renewal to meet both growing energy demand, as well as new applications of electricity, and to harden power lines to face extreme weather events.

ELECTRIFICATION

Prysmian will take advantage of the multiple applications of electrification worldwide across its two segments – Industrial & Construction and Specialties. Electricity will jump to 20% of total energy demand by 2030, and 45% by 2050, including the significant increase coming from data centers which is predicted to become 14% of all US energy demand by 2030, up from 6% today. Prysmian is excellently positioned to take advantage of these opportunities thanks to innovative and sustainable solutions, including Encore Wire which has enhanced access to all verticals of electrification in the US, together with its unique rapid service business model. Prysmian confirms that 70% of the expected €140 million run rate EBITDA synergies from the acquisition of Encore Wire will be achieved by 2026.

DIGITAL SOLUTIONS

Digital Solutions will be boosted by the market trends ranging from increased mobile use, the development of data centers, consumption and the rollout of FTTH. Over $330 billion is expected to be invested in data centers across 2022 to 2030. To take advantage of these opportunities, Prysmian is well placed due to its unrivaled excellence in high quality fiber optic production, and its highly complementary portfolio - including energy solutions - to position Prysmian as a one-stop-shop.

The acquisition of Channell, Prysmian’s first major Digital Solutions transaction, will accelerate Prysmian’s journey from cable manufacturer to solutions provider. The combined portfolio of Prysmian and Channell solutions, along with Channell’s extended commercial reach and complementary R&D focus, will support the development of Prysmian’s North American footprint, positioning the business for growth of data centres and the roll-out of FTTX and 5G in the United States and Europe.

INNOVATION AND SUSTAINABILITY

INNOVATION

Prysmian will utilize its enhanced R&D footprint and sustainability leadership to drive growth.

Prysmian is targeting a new product vitality6 of 30% by 2028, a significant increase from 5% in 2007, and 24% in 2024. Prysmian is enabled in this journey by its 1,100 R&D professionals, and 27 R&D centers globally.

Prysmian will continue to create innovative solutions in partnerships with customers, setting the bar for world class solutions that build on recent achievements such as the world record depth for deep sea installation, the longest ever interconnector and excellence in monitoring and safety services as well as the highest quality cables from an efficiency, resistance and sustainability point of view.

SUSTAINABILITY

Climate

Prysmian is committing to a significant acceleration of its sustainability targets, with the aim to become Net Zero by 2035 (bringing it forward from the original target of 2050) thanks to a significant reduction in Scope 3 carbon emissions. This will help Prysmian reach Net Zero fifteen years ahead of schedule, despite its significantly extended perimeter. Prysmian will make a 60% reduction of scope 1 and 2 carbon emissions by 2030, a further reduction compared to -37% in 2024, with the overall target of -90% by 2035, when compared to the 2019 baseline. This will be achieved despite the larger perimeter, also including Encore Wire.

Thanks to the enhanced use of sustainable materials, and the increase in sustainable solutions rising to 55% in 2028, up from 43% in 2024, Scope 3 emissions should reduce by 65% compared to the 2019 baseline by 2030. In 2024 Prysmian reduced Scope 3 emissions by 54% compared to the 2019 baseline7.

Biodiversity

Prysmian plans to achieve a net gain in biodiversity by 2035, by focusing on the most impactful areas where it operates. In addition, starting from 2025 it will provide updates on its progress by adopting the TNFD (Taskforce on Nature-related Financial Disclosures) framework.

People

Prysmian will also work towards the target of more than half of all its employees to be shareholders of the company by 2028.

PRESENTATION AND Q&A SESSION

Prysmian’s leadership will present the strategic plan on 26th March 2025 at 13.30 CET and 08.30 Eastern Time (USA) at an event for the financial community to be held at the Casa Cipriani, New York City.

The event will be simultaneously webcast. To access please register on this page https://www.prysmian.com/en/investors/capital-markets-day/register-to-watch

A recording of the conference call will be subsequently available on the Group’s website: www.prysmian.com. The documentation used during the presentation will be available today in the Investor Relations section of the Prysmian website at www.prysmian.com and can be viewed on the Borsa Italiana website www.borsaitaliana.it and in the central storage mechanism at http://www.emarketstorage.com.