Prysmian: excellent margins and cash generation

- ADJUSTED EBITDA AT €1,409M (+9.6%), WITH AN IMPROVING MARGIN AT 11.4%

- 3Q ORGANIC GROWTH +1.8%, AND EXCELLENT MARGINS AT 11.9% (10.7%, 3Q23)

- OUTSTANDING IMPROVEMENT IN TRANSMISSION’S PROFITABILITY AND ORGANIC GROWTH THANKS TO SOLID DELIVERY AND PROJECTS WITH IMPROVED MARGINS

- POWER GRID PROFITABILITY BOOSTED THANKS TO GRID ENHANCEMENT IN NORTH AMERICA AND EMEA

- INTEGRATION WITH ENCORE WIRE PROCEEDING ACCORDING TO SCHEDULE, I&C MARGIN IN 3Q RISING TO 11.5% (+2.1 P.P. vs. 3Q23), DRIVEN BY THE CONSOLIDATION OF ENCORE WIRE

- GROUP NET PROFIT ROSE TO €619M (€575M, 9M23)

- OUTSTANDING CASH GENERATION WITH FREE CASH FLOW LTM AT €979M

- STRONG IMPROVEMENT IN RECYCLED CONTENT AND GREEN PRODUCTS

- PRYSMIAN’S 2025 CAPITAL MARKETS DAY WILL BE HELD IN THE USA IN 1Q25;

- Capital Markets Day presentation will take place on 26th March 2025 in New York City, and site visit to Encore Wire in McKinney, Texas on 27th March 2025

Massimo Battaini, Prysmian CEO, said: “Prysmian has continued to deliver excellent margin improvements and cash generation. The results demonstrate that Prysmian is well positioned to achieve organic growth and margin improvement. The strong performance of Transmission and Power Grid, growing in both sales and profitability, is complemented by the improvement in our industrial and construction margin in the third quarter, which for the first time, includes Encore Wire within the perimeter, underlining the strong cultural fit between the businesses, and the overall positive impact of the acquisition on our performance. Prysmian’s strong track record of delivery has enabled us to confirm our 2024 outlook, which we upgraded at 1H24, and we look forward to sharing ambitious new targets with the market at Prysmian’s second ever capital markets day in New York City next March."

FINANCIAL HIGHLIGHTS

The Board of Directors of Prysmian S.p.A. have approved the Group’s consolidated results for the first nine months of 20242.

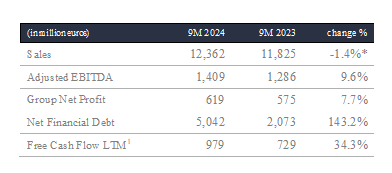

Group Sales amounted to €12,362 million, with a -1.4% organic growth. Improvements in Transmission (+12.3% organic growth) and Power Grid (+1.8% organic growth) was offset by a contraction in Electrification (-3.0% organic growth) and Digital Solutions (-17.3% organic growth). In the third quarter there was an overall positive 1.8% organic growth, led by Transmission (+17.5% organic growth) and Power Grid, which offset the decline in Electrification and Digital Solutions.

Adjusted EBITDA grew to €1,409 million (€1,286 million, 9M23), with the margin increasing to 11.4% (10.9%, 9M23). The adjusted EBITDA, and adjusted EBITDA margin, of Transmission rose to an excellent €242 million, and 14.4%, respectively, while Power Grid’s adjusted EBITDA grew to reach €357 million (€287 million, 9M23), with the margin at 13.3%. In the Electrification business, the adjusted EBITDA rose to €689 million, with the margin at a strong 9.8%. In particular, the adjusted EBITDA of Industrial and Construction was €435 million, with the adjusted EBITDA margin rising to 10.0%, mainly due to the consolidation of Encore Wire. In Specialties, the adjusted EBITDA was €251 million, with the margin at 10.8%. In Digital Solutions the adjusted EBITDA was €121 million, with the margin at 12.3%. The adjusted EBITDA in the third quarter was €540 million, up from €408 million at 3Q23 also driven by the inclusion of Encore Wire in the consolidation, whereas the adjusted EBITDA margin improved by 1.2 p.p. to reach 11.9%.

EBITDA was €1,309 million (€1,192 million, 9M23), including net expenses for company reorganisations, non-recurring expenses, and other non-operating expenses of €100 million (€94 million, 9M23). Net profit stood at €634 million (€588 million, 9M23). Net profit attributable to owners of the parent company amounted to €619 million (€575 million, 9M23).

Free Cash Flow LTM rose to €979 million, compared to €729 million at September 2023 and to €724 million at FY2023.

Net Financial Debt increased to €5,042 million from €2,073 million at 9M23, this reflected, among the main factors:

- the acquisition of Encore Wire (+€4,089 million impact);

- the conversion of the Convertible Bond completed in July (-€733 million) partially offset by the share buyback launched in June (+€166 million);

- the dividend to shareholders paid in April (+€200 million);

- the free cash flow earned in the last twelve months for - €979 million generated by:

- €1,302 million in net cash flow provided by operating activities before changes in net working capital;

- €563 million in net cash flow provided by changes in net working capital;

- €817 million in cash outflows for net capital expenditure;

- €85 million in payments of net finance costs;

- €16 million in dividends received from associates.

1FCF LTM (last twelve months) excluding Acquisitions & Disposals and Antitrust impact.

2The voluntary limited review on the Third Quarter Financial Report at September 30, 2024, has not yet concluded.